24+ arkansas pay calculator

Simply enter their federal and state W. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Arkansas.

24 Acres Of Improved Land For Sale In Oden Arkansas Landsearch

Web Arkansas Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal.

. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Web Arkansas tax year starts from July 01 the year before to June 30 the current year. Web The state income tax rate in Arkansas is progressive and ranges from 0 to 55 while federal income tax rates range from 10 to 37 depending on your income.

Supports hourly salary income and. Then enter your current payroll. Web This calculator helps you determine the gross paycheck needed to provide a required net amount.

The 2022 rates range from 03 to 142 on the first 10000 in wages paid to. Web As an employer in Arkansas you have to pay unemployment insurance to the state. First enter the net paycheck you require.

Well do the math for youall you. Web Arkansas Paycheck Calculator. Simply follow the pre-filled calculator for Arkansas and identify your withholdings allowances and filing status.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Web How do I use the Arkansas paycheck calculator.

Enter your info to see your take home pay. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Arkansas. Web Arkansas Income Tax Calculator 2022-2023 If you make 70000 a year living in Arkansas you will be taxed 11683.

This free easy to use payroll calculator will calculate your take home pay. Web Calculate your Arkansas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Web Use our free Arkansas paycheck calculatorto determine your net payor take-home pay by inputting your period or annual income along with the necessary.

Your average tax rate is 1167 and your marginal.

Disaster Risk Analysis Part 2 The Systemic Underestimation Of Risk

Arkansas Salary Paycheck Calculator Gusto

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Host Pay Calculator Airinc Workforce Globalization

22093 Highway 12 Gentry Ar 72734 Mls 1239839 Redfin

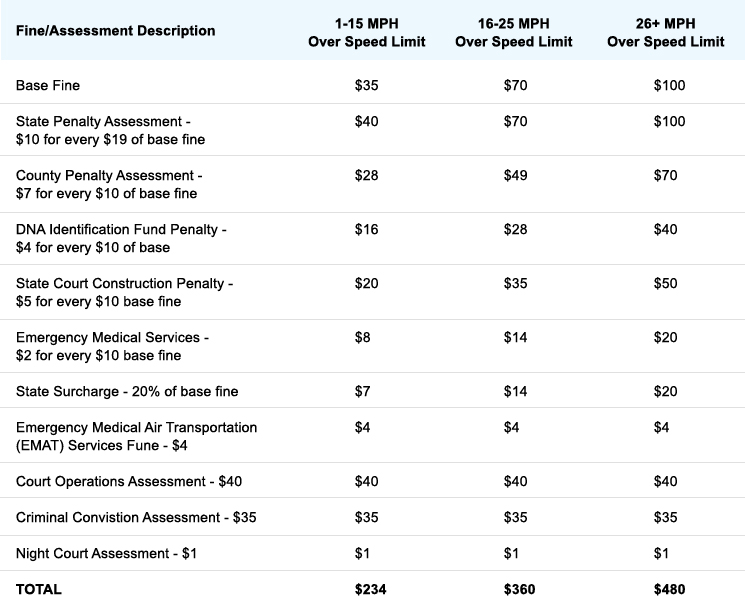

How Much Is A Speeding Ticket In California Ca Speeding Ticket Costs

4716 E Hewitt Springs Rd Springdale Ar 72764 Realtor Com

4562 Highway 88 W Oden Ar 71961 22014458 Mcgraw Realtors

Paycheck Calculator Take Home Pay Calculator

Disaster Risk Analysis Part 2 The Systemic Underestimation Of Risk

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Templates Printable Free Paycheck Pay Calculator

How To Create A Paid Time Off Pto Policy Free Template

Arkansas Paycheck Calculator Tax Year 2023

6684 Leichtlin Ln Midpines Ca 95345 Mls 585989 Zillow

In Tax Season How Can Veterans Maximize Their Tax Benefits Va News

24 Must Read Marketing Books Written By Women

Paycheck Calculator Take Home Pay Calculator